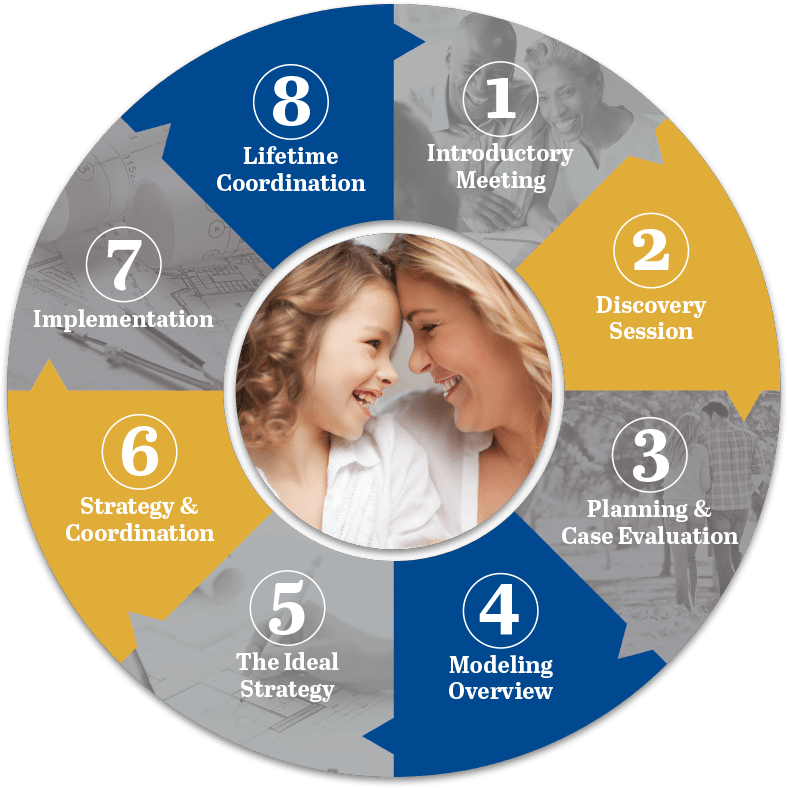

The Financial

Architecture Experience™

As a result of the work we do, our clients are empowered with a lifelong framework for making the most efficient and effective financial decisions. Our goal is to help them achieve maximum results while minimizing risks.

The Discovery Phase

(Steps 1-2)

Working closely with a Financial Architect™, participants will experience interactive and engaging discussions designed to identify their current financial condition across three spectrums – protection, savings assets, and growth assets. In the introduction to The Financial Architecture Experience™, economic concepts and principles are introduced to lay the ground work for future meetings and discussions.

A confidential financial questionnaire is completed and any supporting documents needed are identified and collected. In addition, a review of Dangers, Opportunities, and Strengths ensure the most client centric strategy, one that is both efficient and effective. This initial discovery phase is complete once full and accurate information is organized and provided to Financial Architects.

The Modeling Phase

(Steps 3-5)

The economic model is introduced and participants will, many times for the first time, see their entire economic life presented in one clear and organized model. A tutorial of the model introduces participants to the structure and makeup of its components, as well as an understanding of how their data will be represented throughout the process.

Typically one of the most engaging sessions of the entire process, a participant’s model is then compared with the ideal model. Self-discovery begins as the client is guided through the economic rules of wealth building and learns the characteristics of the ideal model in the three phases of life – accumulation, distribution (retirement), and estate transfer. The Financial Architect™ Advisor will work closely with the participant to identify gaps between their model and the ideal model, and provide guidance for actions steps to make progress toward their maximum financial potential.

Implementation and Strategy

(Steps 6-7)

The outcome of this phase of design is to pursue the highest value path toward maximum efficiency and financial potential. In The Financial Architecture Experience™, economic concepts and principles help achieve the highest financial efficiency. Cash flows are automated to the greatest degree possible and the outcomes from this phase are new money flows, maximum protection, reduced risk, and substantially higher reliability of financial success.

Finally, regarding implementation, there is a complete review of where the process started, what improvements were made, and what progress toward the ideal model was accomplished in the first phase of engagement. All actions steps are completed and documented.

Lifetime Coordination

(Step 8)

Now that the working financial strategy has achieved an initial level of efficiency, the ongoing check-in and monitoring of the strategy begins, referred to as Lifetime Coordination. This is an individualized schedule of reviews with clients to maintain this efficient financial model that was focused on in the beginning.

The Financial Architecture Experience™ is a lifelong framework for making the most efficient financial decisions, and this stage is what allows the planning team to keep that commitment.

2024 Annual Workshop

Congratulations Matt Dery!

Our address is changing, but our commitment to clients is not

Matt Makes His Mark at Troy Chamber of Commerce

Plan for tomorrow.

Account for today.

At Financial Architects, we plan with the future in mind… yours. But we also account for today, developing a strategic road map for your unique tomorrow with the understanding that any program we design must perform better today, tomorrow, and at retirement.

Regardless of any product we offer, or any individual’s unique path, our strategies are custom-engineered to help build wealth and minimize risk – all while allowing you to maintain your existing lifestyle. We work closely with each client to provide a blueprint for life planning, based on precision, verifiable metrics and deep-rooted principles.

Success Builders

Emerging professionals that are experiencing growth in family, wealth, and purpose.

Purpose Seekers

Later-career life creates unforeseen challenges as well as exciting opportunities that everyone must eventually navigate.